Important Tax Breaks for Pass-Through Businesses

About 96% of U.S. businesses are pass-through entities that do not pay taxes at corporate rates. When a business is structured as a sole proprietorship, S-Corporation, partnership, or limited liability company (LLC), the profits flow to the owners, who report the net income on their individual tax returns and pay tax at individual rates.1

If you receive income from a pass-through, you might benefit from one or more of the following tax deductions, which can be quite generous.

Qualified business income deduction

Business owners, self-employed workers, and taxpayers who receive rental or royalty income from pass-through entities might be able to deduct up to 20% of their qualified business income. In 2025, those with taxable incomes up to $197,300 ($394,600 if married filing jointly) generally may claim the full deduction, and those with taxable incomes between $197,301 and $247,300 ($394,601 and $494,600 for joint filers) may be able to claim a partial deduction.

When taxable income exceeds $197,300 ($394,600 for joint filers), the deduction may be limited or eliminated altogether. For example, high-earning professionals in specified service businesses, including health, law, accounting, actuarial science, performing arts, consulting, athletics, and financial services are generally not allowed to take the deduction.

Also, the deduction is generally limited to the greater of 50% of W-2 wages reported by the business, or 25% of the W-2 wages plus 2.5% of the value of qualifying depreciable property held and used by the business to produce income. This means larger businesses without employees could miss out on the deduction.

The income thresholds that determine eligibility are adjusted annually for inflation, and like many provisions of the 2017 Tax Cuts and Jobs Act, this deduction is scheduled to expire after 2025 unless Congress acts to extend it.

Information Gap

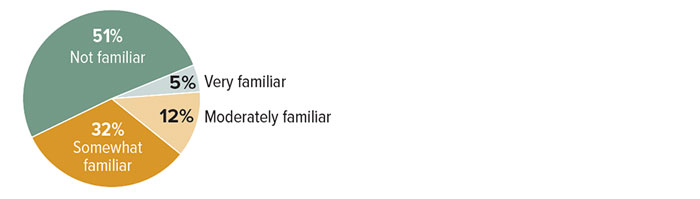

According to a 2024 survey, more than half of small business owners said they were unfamiliar with provisions of the 2017 Tax Cuts and Jobs Act (TCJA) that might be helping to reduce their tax bill. One likely explanation for this is that nine out of 10 small businesses rely on a professional to prepare their tax returns.

Small business owners’ familiarity with the TCJA

Source: NFIB Tax Survey, 2024

Investment write-offs

Section 179. Small businesses may elect to immediately expense the cost of certain short-lived capital investments (qualified property) rather than recover costs over time through depreciation deductions. In 2025, the maximum amount that can be expensed is $1,250,000, and this maximum deduction phases out dollar for dollar when asset purchases exceed $3,130,000. A wide range of property is eligible for expensing.

Bonus depreciation. For qualified property that was both acquired and placed in service in 2025, 40% of the adjusted basis of the property can be deducted in the first year the property is placed in service. The first-year bonus depreciation percentage will be reduced to 20% in 2026 and would be eliminated altogether beginning in 2027 (under current law).

While these tax breaks are likely to be extended in some form, they could be modified in new tax legislation currently being considered by U.S. lawmakers.